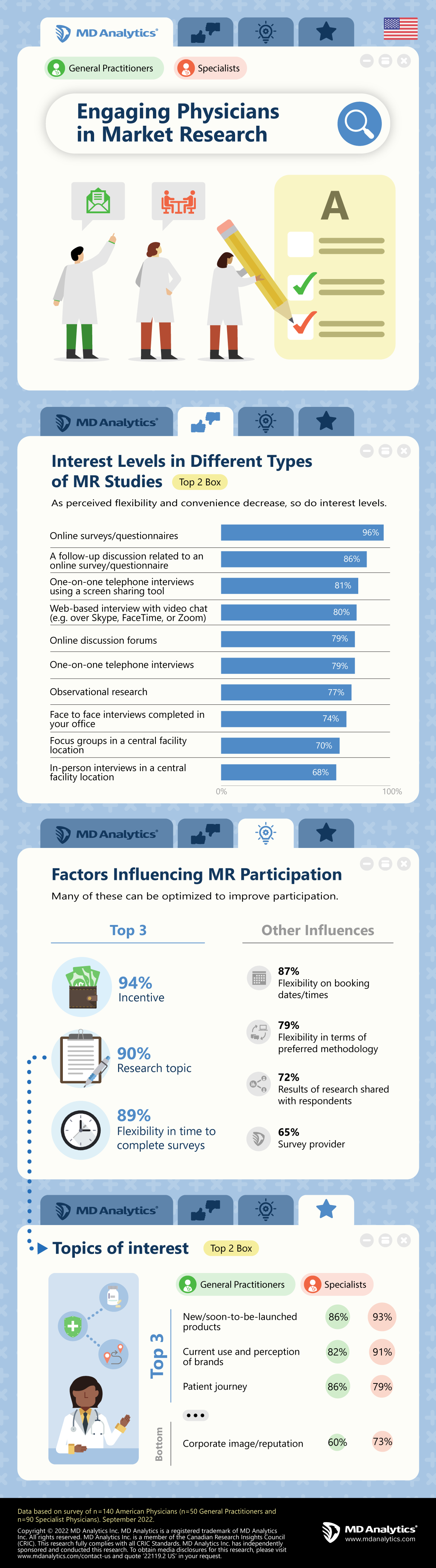

Market research is critical at so many stages of product lifecycles as well as one of the tools to evaluate mergers and acquisitions. We know from our own recruiting efforts and experience with our panel providers that response rates to market research invitations tend to be quite low (often under 20%). We surveyed 150 physicians – 50 general practitioners and 90 specialists – to gauge how different factors impact their interest and participation in market research. Interest levels varied by type of study with the highest level of interest for online surveys. While interest is still fairly high (around 70% top 2 box), falling to the bottom of the list were: face to face interviews in a physician’s office, focus groups in central facility, and in-person interviews in central facility. It seems that post-pandemic there is less appetite for participating in research that requires more effort and time away from work or family. Physicians are likely scrutinizing their time and commitments similar to everyone else.

Read More

Not surprisingly, incentive is the top factor influencing participation in market research. Other factors that have a major influence include: the research topic, flexibility in time to complete surveys, flexibility on booking dates/times for interviews, and flexibility in terms of preferred methodology. Surprisingly, over 70% of physicians (top 2 box) say having the research results shared with them influences their participation. It is not common for clients to want to share findings back with participants but perhaps there is something creative we can do in this space that clients and respondents would be happy with. In terms of the research topic, physicians are most interested in discussing new or soon-to-be-launched products, current use and perception of brands, and patient journey. Specialists are even more interested than GPs in discussing current use and perception of brands, experiences with sales reps, and corporate reputation. However, corporate reputation falls lowest on the list of topics for both GPs and specialists.

Key takeaways

- Could the research be done using a quant methodology, potentially with shorter telephone follow-up interviews?

- Does my survey need to be this long? Could it be completed in multiple sittings rather than all at once? Could it be multiple shorter surveys rather than one long one?

- Is it possible to use more than one methodology to ensure the sample is representative and we get the insights we need?

- Have we worded the topic in the invitation in a compelling way to entice participation?